AMIC Insurance delivered by Marsh

AMIC and Marsh have joined forces to launch AMIC Insurance, a risk management program leveraging the insurance broking expertise of Marsh and deep industry engagement and understanding of AMIC.

The AMIC Insurance team at Marsh is committed to delivering a comprehensive suite of services and solutions for AMIC members, across:

- Insurance;

- Risk Management and Strategy;

- People Risk;

- Workers Compensation; and

- Return to Work.

Marsh saved Hunt & Co Quality Meats time and administrative burden usually associated with Business Insurance renewal thanks to their own industry and processes expertise.

It was great to speak with an insurer that understood the meat industry, compared to a general insurer that did not. With regards to the insurance, we went with AMIC Insurance because Riley from Marsh made the process easy for me, he was just great to work with.

Mick’s Meat Barn were delighted with great value on their Business Insurance thanks to Marsh insurance brokers who understood their insurance needs.

I jumped onto this when I saw the first email come through as our Insurance was due at the end of June. I have an excellent broker I’ve been working with for almost 10 years now but even he couldn’t get close. We saved over $2K with slightly higher excesses! A big thank you to AMIC for the introduction and Marsh for the great work!

AMIC Insurance Program

INSURANCE SOLUTIONS

- Property including business interruption

- Public and Products Liability

- Motor Vehicle

- Trade Credit

- Directors and Officers Liability

- Professional Indemnity

- Cyber Crime

- Machinery Breakdown

- Deterioration of Stock

RISK MANAGEMENT SERVICES

- Educational Workshops

- Risk Identification and Profiling

- Insurable Risk Gap Analysis

- Asset Valuations

- Risk Policy and Procedure Development

- Business Interruption Declared Values Review

- Property Risk Evaluations Surveys

PEOPLE RISK SERVICES

Workforce Strategies

- Compliance and Auditing

- Work Health and Safety

- Employee Accident

Corporate

- Travel and Personal Accident

- Employee Accident and Health

- Organisational reviews

- Employee Value Proposition

Occupational

- Employee Benefits

- Group Salary Continuance

- Life Insurance and Private Health

- Superannuation

- International licensing partners

- Lawsuits and litigation

- Cyber vulnerability

- Balance sheet considerations

- Growth through Mergers and Acquisitions

- Reputational risk

Retail Butchers

Our team of experienced brokers have harnessed the collective risk needs of Australian butchers to secure a comprehensive, industry-wide, business insurance solution.

Business insurance arranged through Marsh includes cover options such as:

- Property Insurer with a higher tolerance cover for EPS Panels (cool room panelling)

- Automatic 100% seasonal increases of stock for 120 days of the policy period

- Business Interruption

- Public and Products Liability

- Portable Equipment

- Money

- Glass

- Variable theft limits including $10,000 limit for theft without forced entry

- Machinery Breakdown and Deterioration of Stock

Smallgoods Manufacturers and Processors

With the added complexities and risk exposures across all businesses in the meat supply chain, AMIC Insurance takes a highly personalised and bespoke approach to developing your insurance program.

Leveraging Marsh’s strong insurer market relationships and global reach, we are able to negotiate competitive premiums on our clients’ behalf and develop a comprehensive insurance program that meets their business needs.

We also continually adapt insurance programs to address issues and meet the current and future needs of our clients by accessing global data insights that help us predict local and emerging issues.

Our Broker value to AMIC members

CLIENT ADVOCACY

At Marsh, we are a team of insurance brokers, advisors and risk management experts dedicated to helping businesses like yours. We are driven by a commitment to deliver industry leading service and value for our clients.

70+ YEARS OF COMBINED EXPERIENCE

With over 70 years of combined insurance broking experience, the AMIC Insurance team at Marsh can help clients design a flexible and resilient insurance strategy that combines traditional insurance policies with innovative solutions.

CLAIMS SUPPORT

Insurance policies are tested by their ability to respond to claims when needed. Our team help to manage, negotiate, and settle claims with insurers on our clients’ behalf, helping to give you peace of mind in the midst of what can a stressful situation.

AMIC Insurance Risk Management Solutions

Our Risk Management team will work with your business to help identify and assess strategic risk.

We have a team of skilled risk management consulting professionals with demonstrated experience in delivering the below solutions, which can result in real and tangible benefits to your business.

Return to Work (RTW) Solutions

Marsh’s in-house rehabilitation and return to work (RTW) provider, Recovre, deliver targeted, effective solutions to help prevent injuries and to facilitate ill or injured employees back into work. The team of experts at Recovre tailor programs for customers based on proven methods evidenced through achieving national return to work rates of 91% with the same employer.

Recovre’s mission is to make a difference by helping people to be safe, healthy and productive at work. AMIC members will have access to a dedicated national rehabilitation and return to work team with local knowledge and expertise to help facilitate early RTW outcomes and reduce workers compensation premium as a result.

Workers Compensation services

The workplace continues to be impacted by several factors: variable economic conditions, workers compensation and workplace health and safety (WHS) reforms, alternative workers compensation insurance arrangements, and emerging workplace and societal issues. Our team combine experience with a broad range of skills to assist clients of various sizes with solutions for their workers compensation, health, and safety challenges.

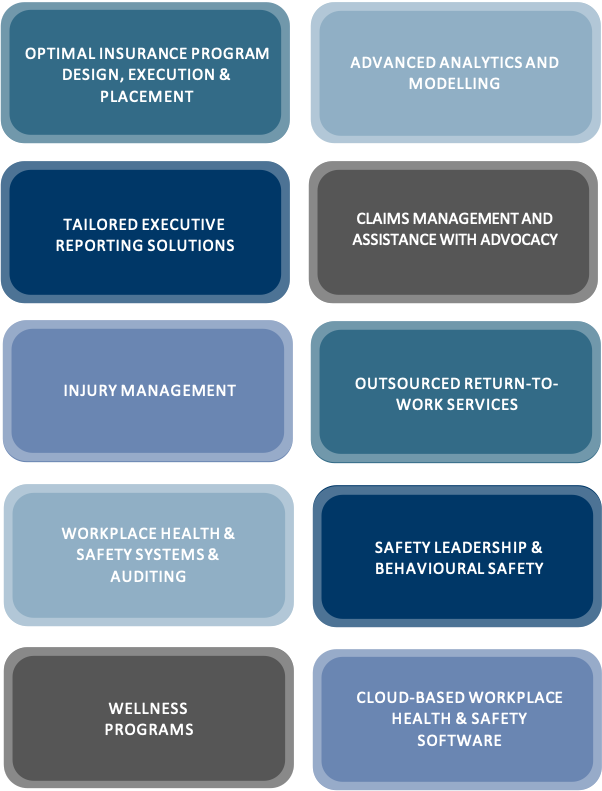

Marsh can provide or arrange the following services:

News & Articles

Thriving beyond burnout – Three actions for improved employee mental health

Employee mental health is one of the most important people risks facing employers today. Issues such as anxiety, stress, depression, and addiction are becoming a source of growing concern in workforces across the world. Mercer Marsh Benefits (MMB), a global leader in...

How an insurance broker can help with your business insurance needs

Every business faces risks. How a business understands, manages and mitigates its risks is key to its ongoing success and growth. A robust insurance and risk management strategy is an effective tool that many businesses employ to minimise their risk and financial...

Insurance renewal considerations

As a butcher you are always putting your customers first, but what about yourself and your own business? Business insurance for your assets and operational liabilities should be a key consideration to be protected from the unexpected. Typical general insurance...

Who is Marsh?

Marsh is the world’s leading insurance broker and risk adviser. We help clients quantify and manage risk – and help them unlock new opportunities for growth.

We understand the importance of creating the ideal balance between providing insurance expertise and a seamless hassle-free purchase or renewal of insurance. AMIC Insurance was created to specifically benefit AMIC members, bringing together the deep insurance broking expertise of Marsh and unrivalled sector understanding of AMIC.

Learn more about Marsh at www.marsh.com/au.

Legal disclaimer

© 2021 Marsh Advantage Insurance Pty Ltd. All rights reserved.

This page contains general information and does not take into account your individual objectives, financial situation or needs. For full details of the terms, conditions and limitations of the covers, refer to the specific policy wordings and/or Product Disclosure Statements available from Marsh Advantage Insurance on request. Marsh Advantage Insurance Pty Ltd (ABN 31 081 358 303, AFSL 238369) arranges the insurance and is not the insurer.

The Australian Meat Industry Council receives a financial benefit when an insurance policy is arranged by Marsh for AMIC Members enabling it to continue to provide further services to Australian meat industry. LCPA 21/129